|

|

![]() |

|

|

|

O

Home Page

O

About Us O

Stock Quotes &

Research O

Upcoming Sector Events

O

Mining

Organizations & Schools

O

Mining Terms - Glossary

O

What is NI-43-101?

|

Feature article December 15, 2016:

WestKam Gold Corp. initiates

10,000t bulk sample, last two bulk samples averaged 26.5 g/T and

16.28 g/T Gold

|

|

WestKam Gold Corp.

(TSX-V:

WKG) (US: ERRCF) (FSE: OUH2) |

WKG.V is due for

near-term upside share price revaluation to reflect the large

inherent value of gold at the Company's 100%-owned Bonaparte Gold

Project, 50 km NW of Kamloops BC;

-

Permitted for 10,000 tonne bulk sample using

existing decline, through the same vein system that yielded 26.5

g/T Gold from bulk sample in 1994 (on 3,700t), and 16.5

g/T from bulk sample in 2010 (on 364.6 dry short tons).

-

The Bonapart Gold Project hosts a series of

well-developed shear/fracture zones hosting near-surface quartz

veins. Drilling has encountered exceptionally high-grade gold

intersections in the 'Discovery Zone'.

-

Additional info from drilling indicates a

minimum 200 meter extension in width to the regional structure,

with more high-grade veins expected to lie within.

-

Highly prospective for new discovery on new

'Cooler Creek' high-grade gold zone along trend.

-

Underexplored 2,216 hectares land package: Government report indicates

the property has potential for large copper-gold porphyry

(similar to what was demonstrated at nearby Highland Valley of

Teck and New Afton Mine of

New Gold).

-

Stable mining-friendly jurisdiction, experienced management team, and skilled

technical leadership.

|

|

Valuation Commentary:

WestKam Gold Corp. (TSX-V:

WKG) (US Listing: ERRCF) (Frankfurt: OUH2) is at the initial

stages of a

10,000 tonne bulk sample on its 100%-owned Bonaparte Gold Project, located 50 km northwest of

Kamloops in British Columbia, Canada. This bulk sample is proximal

the last two bulk samples which averaged 26.5 g/T and 16.28 g/T

Gold, testimony to the exceptionally high-grades contained within a

series of well-developed shear/fracture zones hosting near-surface

quartz veins. WKG.V is in talks with Kinross Gold Corporation

regarding a milling facility for the bulk sample; Kinross' nearby

Kettle River mill facility is the same facility that processed a

total of 364.6 dry short tons from the same deposit of mineralized

quartz vein material averaging 16.28 g/T Gold back in 2010; we

anticipate we'll be seeing high-grade material, comparable to what

was yielded in past bulk samples, again being processed at Kinross'

Kettle River mill facility before the end of Q3-2016, and we expect

WKG.V to have some spectacular new releases over the coming months. More importantly, we see the

big-picture unfolding quickly as the development cuts a 10 by 12

foot drift through a series of high-grade veins and stockwork

(running in between), affirming in the process the findings of a

BCGS report that indicates the property has potential for large

copper-gold porphyry, similar in nature as to what has been demonstrated at nearby Highland Valley Mine

(Teck) and New Afton Mine (New Gold).

WestKam Gold Corp. has

~183.9 million shares

outstanding. The Company is fully financed

(over subscribed in its last financing) to

accomplish all near-term objectives, and

shares of WKG.V are poised for upside

revaluation as the inherent value and accomplishments are

appreciated by the market.

WestKam Gold Corp. has

~183.9 million shares

outstanding. The Company is fully financed

(over subscribed in its last financing) to

accomplish all near-term objectives, and

shares of WKG.V are poised for upside

revaluation as the inherent value and accomplishments are

appreciated by the market.

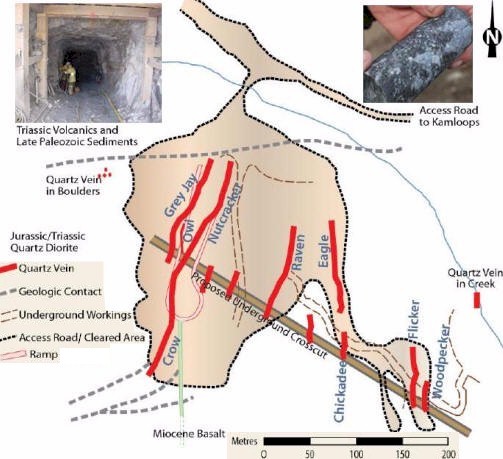

Figure 1. (below) Key veins discovered

to date, inset of underground workings and drill core sample

Work on the property first commenced in 1985

following the discovery of high-grade gold in quartz at surface. 127

diamond drill holes in the 'Discovery Zone' alone, totaling 7,436.6

m, have encountered multiple high-grade drill intersections for gold

(e.g. 113.70 g/t over 0.87 m, 142.97 g/T over 1.2 m, 321.22 g/T over

0.56 m, 115.51 g/t over 1.07 m), revealing a series of gold-laden near-surface quartz veins. The

high-grade vein zones average two-to-three

meters in thickness and appear to be located 12 to 15 meters apart

within a larger regional structure. Exploration to date indicates

the zones are open to expansion in all directions, and a much larger

target zone, located east of the original Discovery Zone, was

identified in the 2015 drill program.

Bulk Sampling

#1) Averaged 26.5 g/T Gold -- In 1994

the Discovery Zone was open pit mined on the Grey Jay/Crow Vein

system. A total of 3,700 metric tons of mineralized quartz vein

material was shipped to the Cominco Smelter in Trail BC, yielding

~98kg (3,160 oz Au) of gold. The bulk sample was halted as they were

deep in the pit and needed to go underground. The shipped ore to the

smelter graded 26.5 g/T Au.

Mining MarketWatch Journal notes very encouraging

observation from past operator at the time of the first bulk

sampling in 1994; the material which

appeared waste at first, as visibly not part of the main vein, when

tested was running ~7 g/T gold (historic, predates NI43-101) for the

~100 m section they needed to chew through to get to the high-grade

vein. That material was left behind and only the higher-grading

hot-spot vein material was transported (thus the 26.5 g/T Gold

average yield), however this observation makes the next bulk sample,

setting-up for this 2016, extremely exciting as it is these large

swaths of stockwork material running full of stringers found in

between the main quartz veins that will determine what may become

the next big mine in B.C.

#2) Averaged 16.28 g/T Gold -- In 2010 a

second bulk sample shipment from the Grey Jay / Crow vein system was

trucked to the Kinross Mill located in Washington State for

processing. A total of 364.6 dry short tons of mineralized quartz

vein material averaging 0.475 oz/ton Au were processed yielding

161.95 troy ounces of gold at a recovery rate of 93.51%.

|

Fig. 2.

(above)

Entrance to portal box cut and ramp road ready to go for

bulk sampling. |

#3)

The current 10,000t Bulk Sampling

WKG.V has a green light to go and

unfold the story without diluting the share structure.

This Q2-2016, WestKam received an underground Bulk Sample Permit

from the BC Ministry of Energy and Mines, allowing for the

extraction of 10,000 tonnes of ore from the Bonaparte Project. The

permitted design of the Bulk Sample program includes extension of

the existing decline approximately 245m through to the Grey Jay /

Crow vein system.

The plan: WKG.V collared the portal in

August and went underground, running at ~15% decline, and from that 100 m

point WKG.V plans to drift another ~245 m of development,

cross-sectioning all the veins on the property, going through the

ore body and seeing how the whole picture looks, and transporting

high-grade vein material to the mill. As these are the same veins,

there is no reason not to expect grades similar in nature to what

was encountered on the first two bulk samples, and we expect WKG.V

to come out well ahead financially once completed (the 1994 bulk

sample yielded over 3,000 oz gold and was only 3,700 tonnes, this

bulk sample should be 10,000 tonnes). There is at least one known

blow-out/jewelry box section in the Crow/Grey Jay vein that WKG.V

will exploit along the way, and all the other veins have never been

mined. By placing vent raises (ventilation shafts to surface)

through high-grade vein structures and areas full of stringers, like

the Nutcracker vein, the Company will maximize yield.

|

As exciting are the riches of this bulk sample,

the more important and lucrative prospect for shareholders will be

the development the bulk sample provides and story that unfolds that

can shed light on the bigger picture and prove up the prospect of

this becoming the next big mine in BC, attracting major area

stakeholders/potential suitors and popping the share price. The bulk

sample should pay for the development and leave several millions of extra

dollars in the Company's treasury to take

the project to another level.

The Company is aggressively moving forward;

|

Figure 3. (above) - Two

boom jumbo procured to make quick work of

underground development |

Figure 4. (above) -

Facilities |

|

Figure 5. (above) -

Upgraded Security |

The Company provided an

update on the progress of the 10,000 t bulk

sample:

The following is from the

September 7, 2016 press release entitled "WestKam

Reports Steady Progress on Bonaparte Bulk Sample";

WestKam Gold Corp. has

provided a progress report on bulk sampling at

the Company's 100%-owned Bonaparte Gold Project

near Kamloops, British Columbia. As of September

1, 2016, the underground decline had reached 156

meters and was cross-cutting the Eagle/Chickadee

vein system. The vein is currently exposed on

the working face. As of the date of this

release, there are 200 meters of decline

development remaining to reach the bulk sample

zone currently scheduled to be intersected by

late October 2016.

"We continue to make

steady progress at Bonaparte," said

WestKam President and CEO Matt Wayrynen. "We've

had our share of challenges along the way, which

we expected. I'm very pleased with how the crews

have responded to each challenge and maintained

the program's momentum." |

Site Commissioning and Underground

Rehabilitation

From July 12th to the 27th, the company completed a significant site

commissioning and underground ramp rehabilitation program. During

this period, 120 metres of the existing decline was scaled,

inspected for rock and ground support conditions and rehabilitated

to a safe working standard. As required, four new safety bays were

emplaced and additional ground support was installed as per the

company's Ground Support Plan. The pre-existing camp facility was

upgraded and brought back into service. The main and ancillary

generators were installed which support the camp and underground

equipment including a two boom jumbo, compressed air lines,

ventilation and pumps.

Sampling for Metal Leaching and Acid Rock Drainage

Initial sampling of the host granodiorite for metal leaching and

acid rock drainage characteristics has also been completed. These

initial results indicate that the host/waste rock characteristics

are non-acid generating. Ongoing acid base accounting (ABA) and

metal leaching (ML) characteristics of the deposit will continue as

the decline advances.

Sampling of the Eagle/Chickadee Vein System

Historically, the Eagle/Chickadee vein system was exposed through

surface trenching over a combined strike length of 75 meters with an

average width of 1.42 meters. Mineralization consisting of pyrite,

pyrrhotite and chalcopyrite was locally noted with total sulphides

up to 10% being reported within the vein. Historical assays reported

grab sample results from trace to 13.8gm Au (0.404 ounces per ton).

Mapping indicates the vein has a true thickness of 30cm to 40cm

striking near north at 350 degree azimuth, dipping 35 degrees to the

east. Alteration along the vein footwall over 20cm to 60cm consists

of strong chlorite + pyrite mineralization while the hanging wall

alteration exposes weak chlorite + pyrite alteration over 1cm to

3cm. Visible sulphides within the vein consist of 5-20% blebby to

stringer pyrite, 1-2% chalcopyrite and 1% pyrrhotite. Near vertical

north -south trending shear structures are noted on the working face

exhibiting sub meter vein displacements. The Eagle/Chickadee vein is

being sampled by both channel and panel sample methods to determine

the optimum sampling system. Samples are currently in for assay and

will be reported once all assays have been received.

Bulk Sample Target

The current bulk sample target is the down dip extension of gold

mineralization exposed in historical surface trenches and is the

site of two historical surface bulk sample programs. In 1994 a total

of 3700 metric tons of quartz vein material was shipped to the

Cominco Smelter in Trail yielding 98kg (3,160 oz Au) of gold at a

grade of 26.5 gm/tonne gold. A second bulk sample program was

completed in 2010 where 364.6 dry short tons of mineralized quartz

vein were shipped to the Kinross mill in Washington State. The 364.6

dry short ton shipment averaged 0.475 ounce per ton gold yielding

161.95 troy ounces of gold at a recovery rate of 93.51%.

...click

here for full copy of Company update from source

The following is copy of WestKam's CEO September

30th, 2016 update to shareholders:

|

The 2016 bulk sample program

continues to move forward, with crews making

improved progress each day towards the target

zone Grey Jay/Crow vein system. There have been

setbacks, of course. Start-ups are never easy,

with equipment breakdowns and other issues that

are always expected when you begin an

underground project. However, we have worked

through these challenges while establishing a

safe, efficient and well-staffed crew at the

Bonaparte camp with the required equipment and

support.

On my latest site visit I was quite impressed

with the efficiency of our crews, which are now

working two shifts per day. We have roughly 10

full time people on site, including underground

miners, mechanics, geologists, engineer and camp

support staff. It's a busy place with lots of

enthusiasm, and morale has come along with each

positive development.

Moving Towards the Grey Jay /

Crow Vein System

As of late September,

including this year's progress since late July,

the decline had progressed approximately 200

metres of the initially laid out 360-meter plan.

Roughly 160 meters of tunnel are remaining to

hit the target zone, the Grey Jay / Crow Vein

System, also known as the "Jewel Box" which was

the source of the historically produced 1994

bulk sample of 3,700 metric tonnes. We expect to

reach this same vein structure sometime in

mid-November, down dip of the pit where that

bulk sample yielded 3,160 ounces of payable gold

from Teck Cominco's Smelter at Trail. Once

intersected, the plan is to further define its

extents with lateral cross cuts on strike. Other

minor veins have been intersected along the

decline at expected intervals, confirming dip

continuities of other quartz veins and

delivering a positive outcome thus far. We will

report on further progress soon.

As always, your support of the company is

greatly appreciated. I welcome your questions

and comments

at any time.

Matt Wayrynen, President & CEO

WestKam Gold Corp.

Matt@westkamgold.com

604.682.3701 |

...Click

here to view full copy from source

------ ------ ------ ------ ------ ------

Discovery Zone Cu-Au

Porphyry Target Extended

- The known 'Discovery Zone' area appears to be

only the tip of the iceberg. IP, magnetic, and geochemical surveys

have revealed a cornucopia of attractive drill targets and affirm

the findings of a BCGS report that indicates the property has

potential for large copper-gold porphyry.

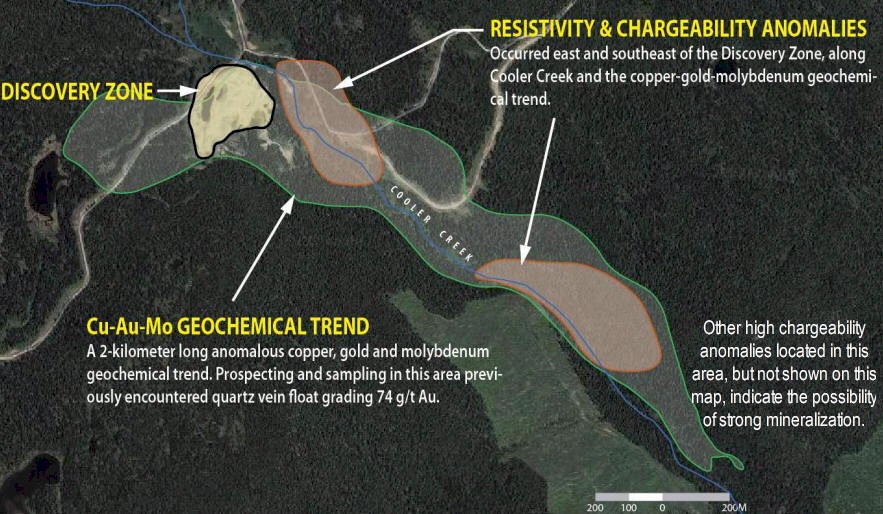

Figure 6. (above) - Annotated map showing

select IP and magnetic geophysical survey anomalies.

Volterra 3D IP and ground magnetic surveys have substantially

extended the strike length of the high-grade Discovery gold zone

trend. The extent of the zone's chargeability and resistivity

anomalies has now been traced 1.2 kms from the Discovery Zone to the

south-southeast, and the zone remains open. Several parallel

features of similar chargeability and resistivity signatures have

also been identified. Additionally, southwest of the Discovery Zone

is a large magnetic anomaly comprised of extreme highs and lows with

coincident IP chargeability responses under a younger basalt cap.

These results suggested potential for a multi-phase intrusive.

The New 'Cooler Creek' Zone

Figure 7. (above) - Annotated map showing

select magnetic geophysical survey anomalies superimposed on an

outline of the geochemical trend. The Cooler Creek Canyon has an

area of resistivity and chargeability anomalies and also contains

part of the 2km long Cu-Au-Mo geochemical trend

A seven-hole, 583.22 metre, drill program

carried out in the fall of 2015, discovered a new vein ~450 metres

east of the Crow/Grey Jay/Owl veins of the Discovery Zone. This new

vein discovery at 'Cooler Creek' from DDH-15-05 (see November 16, 2015 News Release "Assaying

0.253 oz/t Gold, 38.4 g/t Silver, 0.33% Copper and 28.6 g/t

Tellurium, over 1.0 meter") lies

within an anomalous IP resistivity, chargeability and Au/Cu

geochemical trend which extends 1.2 kms to the south-southeast and

is open both northward and southward. WKG.V has plans to drill and

expand upon this new discovery vein.

WKG.V shareholders are in for an exciting

second half of 2016 as the development from the 10,000t bulk

sampling of the Discovery Zone is likely to bring insight and

discovery that has the potential to catapult the Company's share

price. Below is expanded

insight on WestKam Gold Corp.'s Bonaparte Gold-Copper Property.

|

|

|

|

Content found herein is not investment advice

see Terms of Use, Disclosure & Disclaimer

Recent

salient Company news releases

-

October

14, 2016 "WestKam

Gold Announces AGM Results"

-

September 20, 2016 "WestKam

Discussions With Kinross Gold Moving Ahead"

-

September 7, 2016 "WestKam

Reports Steady Progress on Bonaparte Bulk Sample"

-

August

2, 2016 "WestKam

Submits Bulk Sample Material to Kinross"

-

June 28, 2016 "WestKam

to Begin Bulk Sample Program at Bonaparte"

-

June 13, 2016 "WestKam

Prepares for Bulk Sampling Program at Bonaparte Gold

Project"

-

May 16, 2016 "WestKam

Announces Final Tranche ($232,870) Closing of

Private Placement"

-

April

29, 2016 "WestKam

Announces 1st Tranche ($1,741,425) Closing of

Private Placement"

-

April

27, 2016 "WestKam

Announces Private Placement to Existing Shareholders

and Other Investors"

-

April

20, 2016 "WestKam

Receives Bulk Sample Permit for Bonaparte Project"

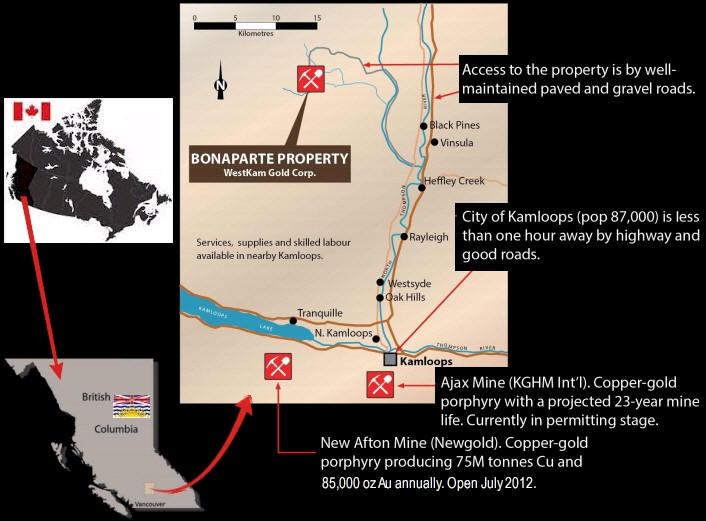

Location, Region, and Infrastructure

WestKam's Bonaparte Gold Project is located in a stable mining-friendly

jurisdiction, and has good infrastructure.

Figure 8. (above) Location

map.

Mining-friendly province of British Columbia, Canada:

British Columbia, Canada is

a stable, mining friendly region and is ranked

as a top-tier jurisdiction by the Fraser

Institute.

Local Infrastructure:

The Bonaparte Gold-Copper

Project is less than an hours drive (~50 km)

northwest of Kamloops in south central British

Columbia. Kamloops is only ~3 hours (310 km)

from Greater Vancouver. Kamloops, with a

mining-friendly population nearing 90,000

people, has a thriving industrial base.

The property itself has

excellent road access (paved roads from Kamloops

for most of the way, then well-maintained gravel

roads to the property), ample water. Power lines

are nearby.

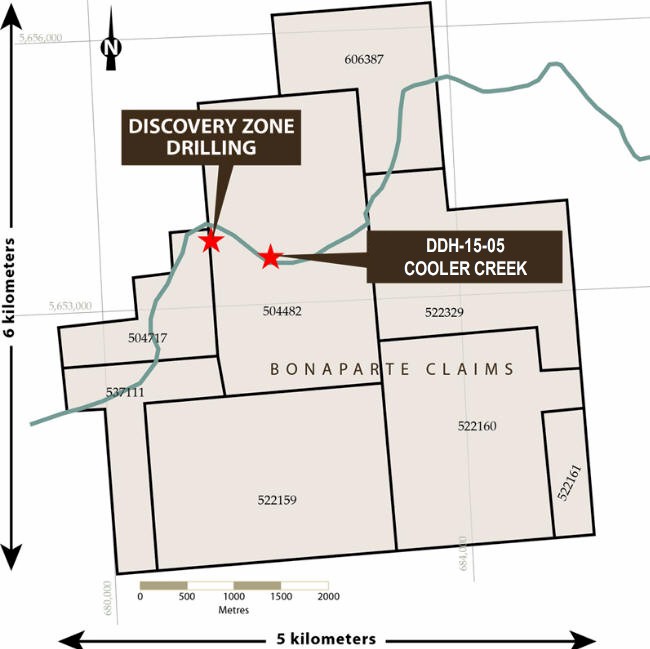

Bonaparte Gold Property

- 2,216 Hectares (5,507 Acres), 100% owned by WKG.V

Figure 9 (above) Bonaparte claims -

The property is largely unexplored. What has been discovered to date is

starting out similar to how all mines of significance in BC had once

started out.

<=

click to access April 2009 NI 43-101 Technical Report

on WKG.V's Bonaparte Gold Project [PDF].

<=

click to access April 2009 NI 43-101 Technical Report

on WKG.V's Bonaparte Gold Project [PDF].

Bonaparte Property History

-

1990s 3,425-ton bulk

sample from one of over 13 identified vein systems

averaged 26g Au/ton (0.75 oz/ton).

-

2009 WestKam Gold

Corp. (WKG) acquires option to earn 60% interest.

-

2010 Small bulk sample

collected from underground workings on Crow vein.

Ore shipped to Kinross Mill in Republic, Washington.

Recovered gold sold for $145,783 (364.61 tons @

0.475 oz/ton, 93% recovery

-

2010 #20 Vein plus

three new veins encountered in decline; WKG

exercises option to earn 75%.

-

2013 BCGS report on

porphyry potential, successful IP geophysics.

-

2013 WKG acquires

additional 17% , brings Bonaparte ownership to 92%.

-

2014 Exploration

advances 2013 discoveries; WKG purchases 100%.

-

2015 Fall diamond

drilling follows up on 2014 results. New vein

discovered, opening up large target area called

Cooler Creek Zone.

-

2016 Permits received

for next bulk sample; dewatering completed in June.

Diamond drilling beneath the

bulk sample pits produced several historic high-grade intersections

including:

|

Grade

(g gold/tonne) |

Grade*

(oz gold/ton) |

Intercept

(Meters) |

|

113.70 |

3.32 |

0.87 |

|

84.21 |

2.46 |

1.44 |

|

142.97 |

4.17 |

1.20 |

|

321.22 |

9.37 |

0.56 |

|

115.51 |

3.37 |

1.07 |

|

43.50 |

1.27 |

1.02 |

|

69.20 |

2.09 |

1.26 |

*Calculated as: 1 gram/tonne

= 34.28 troy ounces/short ton

Additional information from

drilling indicates a minimum 200 meter extension in

width to the regional structure. More veins expected

to lie within the extension.

Bonaparte's

bulk-tonnage, porphyry copper-gold potential

Geological services firm Coast Mountain Geological

Ltd. have completed aggregation and assessment of information

accumulated to date the Bonaparte Gold Project. Based on their work,

development strategy examined both high-grade gold in quartz vein

networks and porphyry copper-gold potential (as has been inferred by

recent study from the British Columbia Geological Survey)...

|

The British Columbia Geological Survey also

independently parallels the interpretation

regarding big porphyry copper-gold potential

based off their own research:

The Bonaparte Copper-Gold

Project was investigated by BC government

geologists Jim Logan and Mitch Mihalynuk in

2012.

They published

'Bonaparte Gold: another

195 Ma porphyry Au-Cu deposit in southern

British Columbia?'

Stating,

It is likely that the

portion (of the Bonaparte Gold Project) explored

to date is only a small part of a much larger,

more extensive mineralizing system that requires

detailed exploration to define. In addition to

the shear/fracture hosted mineralization,

potential exists for large bulk tonnage,

porphyry copper-gold mineralization.

Shaun M. Dykes M.Sc (Eng), P. Geo

(Previous researcher on Bonaparte Property)

Technical Report on the Bonaparte Gold Property

April 30, 2009 |

IP Survey

Results Summary Diagram

Note: This area being

focused on now by WKG.V represents only a fraction of the property --

this area alone has big gold-copper porphyry mine potential written all

over it with potential to rival nearby Highland Valley Mine (Teck) and

New Afton Mine (New Gold).

Figure 10 (above) Summary of survey

anomalies.

##

|

------ ------ ------

------ ------ ------

WestKam Gold

Corp.'s Technical Leadership, Management,

and Governance

The current management team and board of directors has a

well rounded combination of people that each contribute

expertise in disciplines necessary for a successful

mining entity:

Matt Wayrynen, P.Eng, President & CEO

Former director of Quinto Mining Corporation, which was

acquired by Consolidated Thompson Iron Mines in 2008 for

a share value equal to $175M. Original co-founder and

former President and CEO of TrichoScience Innovations

Inc., which was acquired by Replicel Life Sciences Inc.

Helped advance RepliCel to its current market

capitalization of over $100M. Currently a director and

senior officer of several other reporting issuers in the

resource and energy sectors. Also the former President

and CEO of Bralorne Gold Mines Ltd.

Pam Saulnier, B.Sc., CFO

Ms. Saulnier is a Certified Management Accountant and a

member of Chartered Secretaries Canada, a Canadian

Division of The Institute of Chartered Secretaries and

Administrators (ICSA). She has more than 12 years

experience in the mining and resource and oil and gas

sectors. Ms. Saulnier has served with public companies

in financial reporting, regulatory compliance,

governance and administration of corporate affairs.

Akash Patel, Ph.D., Director

Presently CEO of MX Gold Corp. (MXL).

Significant public accounting experience and over 15

years of investing experience. Bachelor of accounting

from the British Columbia Institute of Technology with a

major in accounting and minor in finance. Also provides

over 12 years of corporate tax experience and has been a

director and officer of several other reporting issuers

in the resource sector.

Lincoln Fuqua, Director

35 years experience in Business & Higher Education

Administration; Research Director; Corporation &

Foundation board of directors service; Natural Resources

exploration & development projects partner & manager

Major financial grants from National Science Foundation,

U.S. Department of Education, Utah Education Network, &

American Independent TV Network. Recognized in Whos Who

in Bus. & Computer Technology; Whos Who in Distance

Learning; & Global Business Leaders.

------ ------ ------

------ ------ ------

Lindsey Gorrill, CFO, Advisor

Chartered Accountant, graduate of Simon Fraser

University with a BBA in Finance and Marketing. Admitted

to the Institute of Chartered Accountants of British

Columbia in August 1989. Following senior positions with

Ernst & Whinney, Peat Marwick Thorne and KPMG, Mr.

Gorrill filled executive roles resource companies in

Canada and the U.S. Currently CEO, CFO, Principal

Accounting Officer and Treasurer of Star Gold Corp. and

has been its President since 2008. Also CEO and

President of Jayhawk Energy, Inc. Also served as CEO,

CFO and President of Canada Fluorspar Inc. Former CFO of

Quinto Mining Corp., where he helped raise millions of

dollars and advanced a Quebec iron ore property to a

viable project. Quinto then sold to Consolidated

Thompson Iron Mines in June 2008 for a share value equal

to $175 million. (Consolidated Thompson was eventually

sold to Cliffs Resources for $4.9B.) .

Tyrone Docherty

Chief Executive Officer and President of Deer Horn

Metals Inc. since 2008. Former President and CEO of

Quinto Mining, where with limited resources in a

difficult market he raised more than $30M and advanced a

Quebec iron ore property into a viable project. Quinto

was subsequently sold to Consolidated Thompson Iron

Mines in 2008 for a share value equal to $175M (starting

from $4M). Consolidated Thompson was eventually sold to

Cliffs Resources for $4.9B. Mr. Docherty also serves on

the Boards of several resource companies including

JayHawk Energy Inc. as well as Quinto Mining Corp.

(prior to its sale). Involved in the financial markets

for over 20 years and attributes his success to

relationship-building, trust and honesty.

Tony Fogarassy, M.Sc, LL.Mc

Natural resources lawyer and principal for Dunbar Law

Corporation. Graduated as the gold medalist in

geological sciences and obtained his masters degree at

the University of British Columbia. Obtained law degrees

from UBC and the London School of Economics. Tony's

legal experience includes mining, environmental and

aboriginal law. He has worked as a geologist or lawyer

on projects in Canada, USA, Kazakhstan, Angola and the

Middle East.

Bob Lane, M.Sc., P. Geo, Consultant/Advisor &

Qualified Person

Registered professional geologist with a Master's degree

in geology and more than 20 years of practical field

geology as a research geologist with the BC Geological

Survey, as the Regional Geologist with the Ministry of

Energy & Mines (Northeast-Central Region of BC), and as

a consulting geologist. Currently the principal of

Plateau Minerals Corp, a geological consulting company

based in Prince George, and a Qualified Person under NI

43-101.

Note: This list is not intended to be a complete overview of

WestKam Gold Corp. or a complete listing of WestKam's

projects. Mining MarketWatch urges the reader to contact the subject

company and has identified the following sources for information:

For more information

contact WestKam Gold Corp.'s head office at:

Ph (604).682.3701

Company's web site:

http://www.westkamgold.com

SEDAR Filings:

URL

|

|

|

![]() |

|

![]() |

|

Welcome to Mining

MarketWatch

We provide insight into resource

companies, many which are so often overlooked gems and can provide

exceptional potential to richly reward investors. The

companies we select offer outstanding properties, management and

experience in the mining/exploration industry.

|

Sector NewswireTM

Editorials:

|

|

Sector NewswireTM

Top News Stories:

|

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/tny_ag_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/platinum/tny_pt_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/palladium/tny_pd_en_usoz_2.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-cad-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)

|

|

|